Qbi Deduction 2025

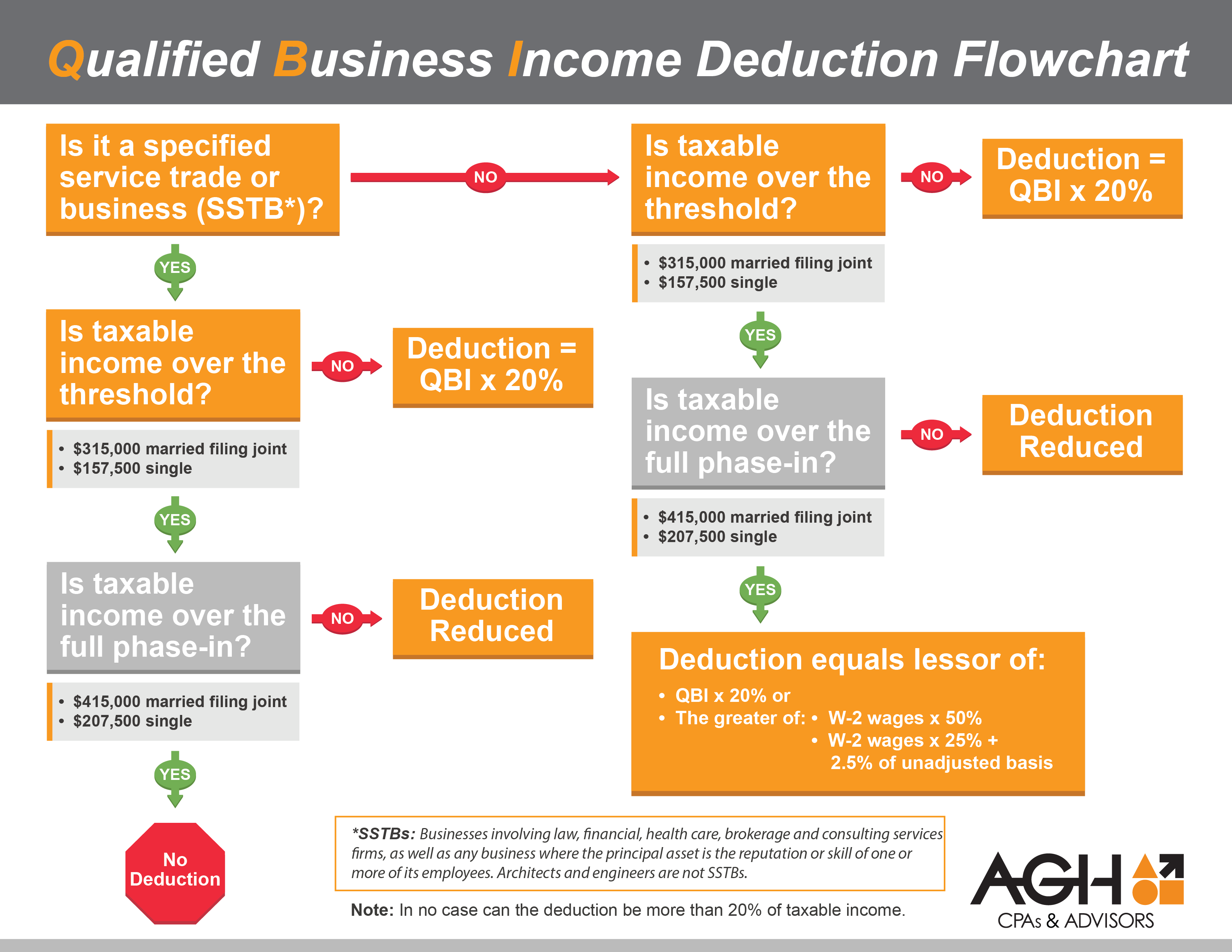

Qbi Deduction 2025 - The qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. The threshold ranges from $160,700 to $210,700 for single filers and from $321,400 to $421,400 for married filing jointly. Qualified Business Deduction QBI Calculator 2023 2025, The qualified business income (qbi) deduction is available to eligible individuals through 2025. And with the new financial year beginning soon, taxpayers would again be required.

The qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. The threshold ranges from $160,700 to $210,700 for single filers and from $321,400 to $421,400 for married filing jointly.

What Is the QBI Tax Deduction and Who Can Claim It?, The qbi deduction is the lesser of (1) 20% of qbi or. Jul 15, 2025 • 4 min read.

After that, it’s scheduled to disappear, unless congress passes.

Section 199a is a qualified business income (qbi) deduction that allows you to potentially deduct 20% of taxable income minus capital gains.

Nca Holiday Classic 2025 Results. Welcome to the 2025 college classic national championship! Milesplits official […]

QBI Deduction What It Is, Who Qualifies & How to Take It Hourly, Inc., Basically, the deduction allows taxpayers to deduct 20% of the qbi from qualified businesses owned by the taxpayer. “[this] allows eligible taxpayers to deduct 20% of qbi under specific.

Qualified Business (QBI) Deduction, The qualified business income (qbi) deduction is a tax break that’s been given to certain business. After that, it’s scheduled to disappear, unless congress passes.

The threshold ranges from $160,700 to $210,700 for single filers and from $321,400 to $421,400 for married filing jointly.

Can qbi be investment, Income tax rates will increase and the standard deduction will be reduced. For more information on the qbi deduction, read the relevant irs article on qbi deductions or speak to a tax professional.

How to calculate a qualified business income deduction.

What Is the Qualified Business Deduction (QBI), and Can You, For more information on the qbi deduction, read the relevant irs article on qbi deductions or speak to a tax professional. Section 199a is a qualified business income (qbi) deduction that allows you to potentially deduct 20% of taxable income minus capital gains.